The market environment for ethical drugs in Japan is seeing stepped-up efforts to create an ecosystem for innovation in drug discovery, while being increasingly pressured every year by developments including the annual NHI drug price revisions, which are being carried out again in fiscal 2025 for the eighth consecutive year.

Methods of providing information are diversifying, including the use of digital technologies during and after the COVID-19 pandemic, and work-style reforms for physicians and other changes are anticipated. Given this environment, the Kyorin Group has decided to “maximize the ratio of new drugs” as one of our business strategies under the medium-term business plan “Vision 110 Stage1–”, with the aim of growth through the increased market penetration of new drugs.

We will emphasize the market penetration of new drugs by accurately identifying the needs of medical institutions through quality communication based on in-person meetings with medical practitioners.

Through the stable supply of quality pharmaceutical products, we are working to maximize product value by contributing to the treatment of the many patients who need our products.

Changing environment

- Promotion of measures to control medical expenses and drug costs associated with pressure on public finances for medical care

- Growing need for diagnosis and prevention in addition to treatment

- Changes in the way information is provided to the medical field

Opportunities

- Expanded lineup and market penetration of new drugs

- Increased demand for testing and greater number of patients associated with spread of infectious diseases

- Development of digital methods for providing a wide range of information

Risks

- Decline in sales and earnings of main products due to annual drug price revisions

- Diversifying needs for pharmaceuticals and medical devices associated with changing environment

- Reduced opportunities for communication with physicians due to factors including restrictions on MRs’ visits

Medium-term business plan

Vision 110 –Stage1– initiatives

Business strategyMaximizing the ratio of new drugs

Emphasize proliferation of new drugs

- Promote in-person meetings with physicians to increase the impact of medical details and accelerate the growth of new drugs *

- * New drugs: Beova / Lasvic / Lyfnua / Desalex / Flutiform, etc.

Promoting activities to provide solutions

We believe that two-way communication with medical practitioners is important for MRs to completely fulfill their original role of “achieving appropriate use of pharmaceuticals and contribute to medical care by providing, collecting, and conveying pharmaceutical information.” The COVID-19 pandemic placed restrictions on MRs’ visits to medical institutions and in-person meetings with medical practitioners. In response, we promoted the use of digital technologies in our activities to provide information. Against this backdrop, we are working to achieve even better communication with medical practitioners by providing solutions through activities that integrate visits to medical institutions that focus on in-person meetings with digital channels.

We are providing all MRs with training in the detail skills needed to propose solutions that comprehensively resolve issues related to the diseases that our products address and training in coaching skills for all sales office heads. Along with this training to enhance overall capabilities, we are analyzing marketing data collected internally to identify the needs of medical practitioners, an approach that is leading to high-quality activities in providing information.

Our activities to provide solutions begin by hypothesizing problems from the patient’s perspective and identifying current needs to formulate issues, then proposing a drug formulation from our range of products. For infectious diseases, for example, we provide comprehensive information that includes introducing Milton and Rubysta for infection control and prevention at medical institutions, GeneSoC for identification of pathogenic microorganisms (diagnosis), and Lasvic for the appropriate use of antimicrobials (treatment). In the areas of respiratory and otolaryngology, we address various diseases by proposing appropriate drug formulations from our expansive product lineup that includes Lyfnua, Lasvic, Desalex, and Flutiform. Through these and other efforts, we are providing information that contributes to resolving issues in response to the needs of medical practitioners and working to emphasize the proliferation of new drugs.

Continuous growth by raising the ratio of new drugs

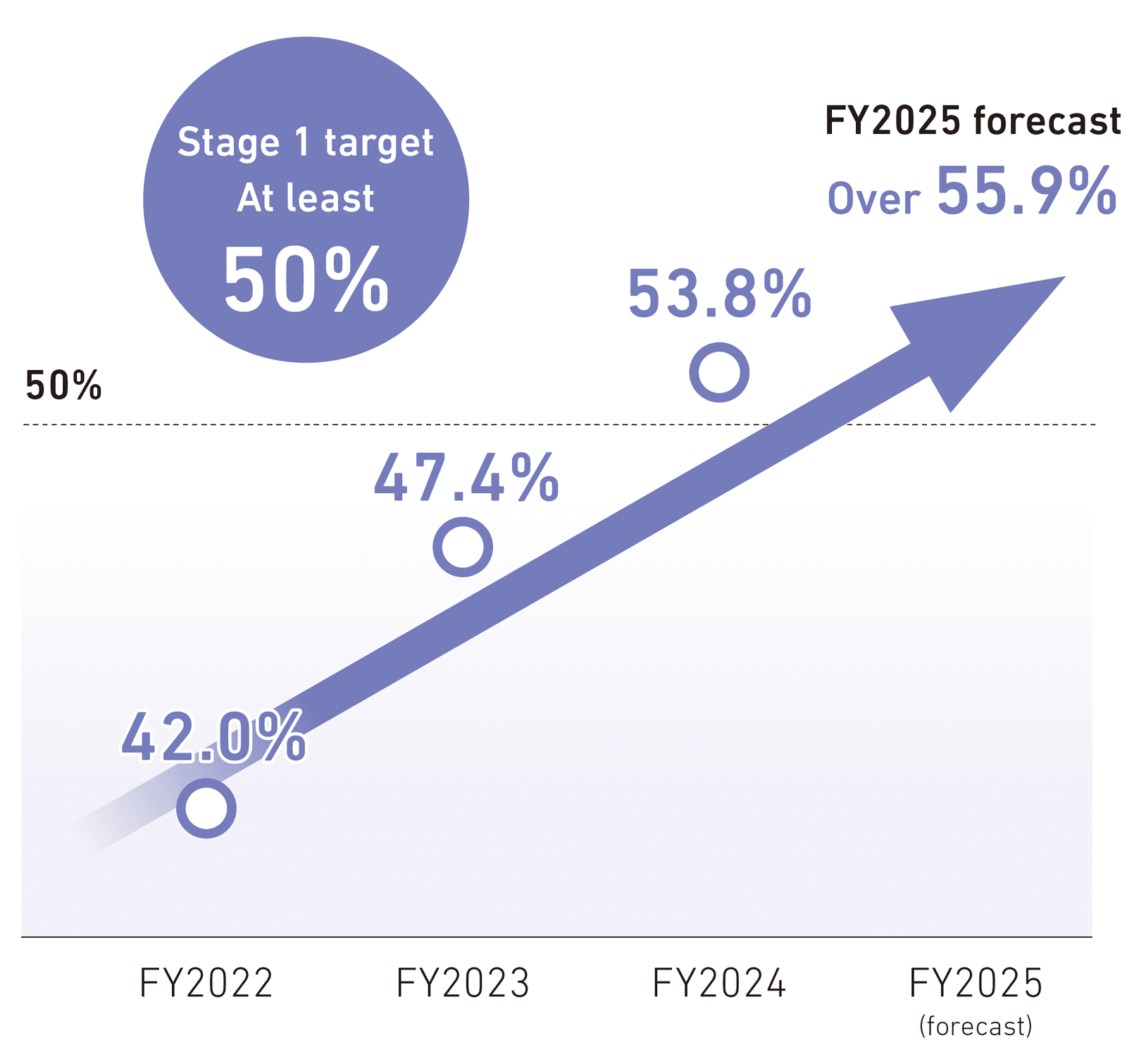

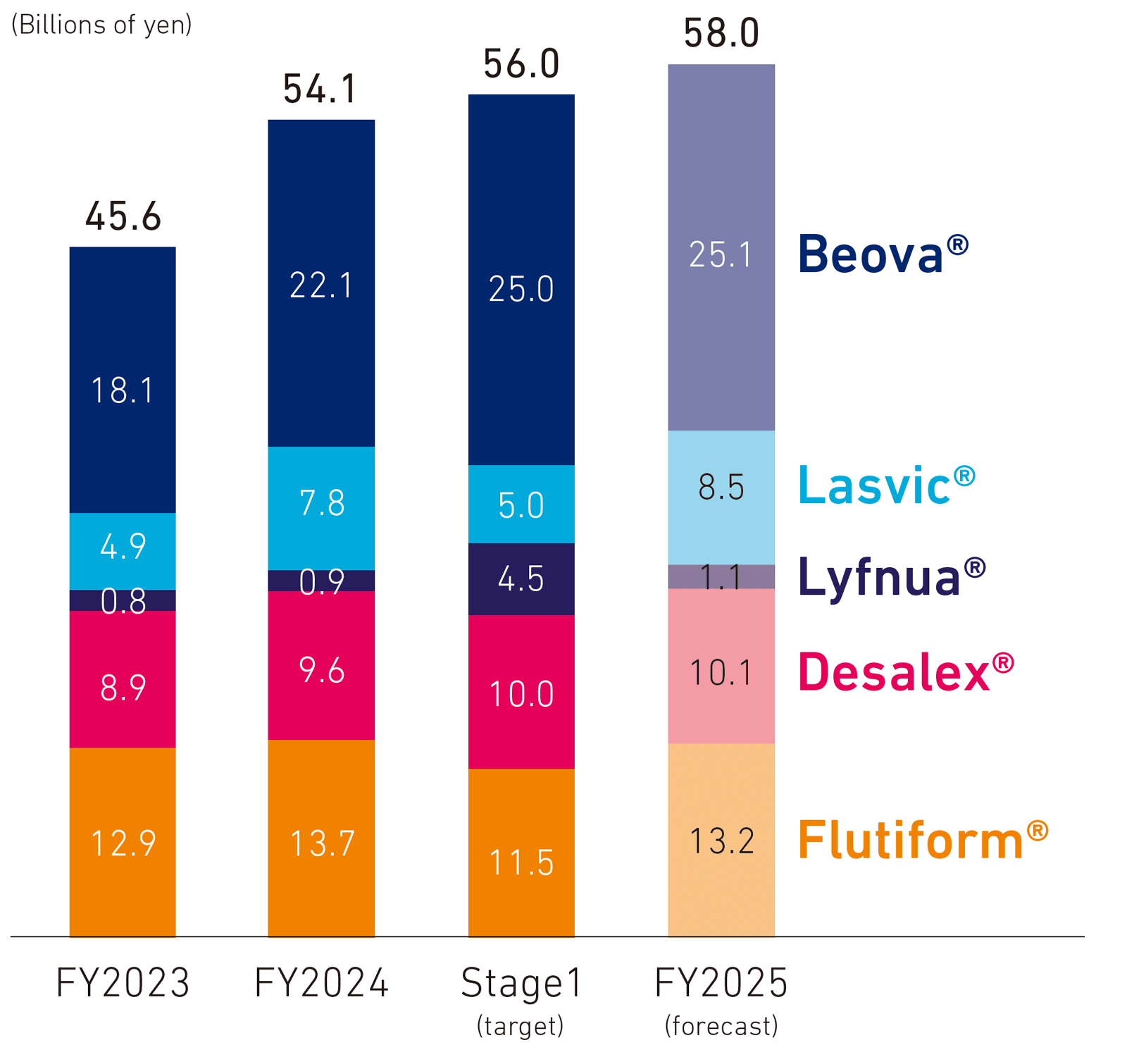

Recognizing that focusing on expanding the use of new drugs to accelerate growth is important for achieving a growth trajectory, we have set the ratio of new drugs as a percentage of total domestic ethical drug sales as a KPI and are working to maximize their use in the market. As a result, our ratio of new drugs in fiscal 2024 was 53.8%, surpassing the Stage 1 target of at least 50% one year early.

Beova, which is highly regarded by many physicians for its efficacy and safety, acts on β3 adrenaline receptors in the bladder smooth muscle to improve symptoms of overactive bladder (OAB) by increasing bladder capacity. More than 10 million people in Japan suffer from OAB, and although this is not a life-threatening disease, it has a significant negative impact on patients’ quality of life. However, the percentage of people receiving treatment is extremely low. In the belief that many people are missing opportunities for treatment, we are proactively engaged in new activities to raise awareness of the disease to increase treatment rates.

Lasvic is a new quinolone antibacterial agent listed in multiple guidelines as a recommended drug for infection. In recent years, pathogenic microorganisms such as bacteria have acquired resistance to antibacterials, creating a major social issue with the increase in antimicrobial resistance (AMR) when drugs cease to be effective. Kyorin has promoted treatment and approaches based on guidelines to promote the appropriate use of antibacterial agents.

Lyfnua is the only drug effective for treating refractory chronic cough. Our analysis has shown that because Lyfnua has a taste-related adverse event and produces effects relatively quickly, patients take the drug for fewer continuous days than we had estimated. Since the JRS Guideline for the Management of Cough and Sputum (April 2025) clearly defines refractory chronic cough and recommends P2X3 receptor antagonist as a treatment, we are working to increase Lyfnua’s market penetration as the only recommended treatment. Desalex is a product with a high degree of prescription compliance taken once a day to control allergic symptoms. In addition to not causing drowsiness and instructions that do not warn against driving an automobile, it is not affected by meals and can be taken without disrupting patients’ lifestyles. We will continue to promote its market penetration as a medication that is both effective and easy to use.

Flutiform is an ICS/LABA (Inhaled corticosteroids/Long-acting β2-agonists) compound that expands the respiratory tract to control inflammation and prevent outbreaks from occurring. Its aerosol formulation allows older people, women, and other patients with weak inspiration to take it easily. We see Flutiform contributing to treatment for asthma sufferers going forward.

- Ratio of new drugs

- Sales of five major products

Establishing a presence in designated fields

In line with the FC strategy of concentrating resources in the fields of respiratory, otolaryngology, and urology, our approximately 600 MRs are providing, gathering, and transmitting information to medical practitioners regarding the appropriate use of pharmaceuticals with the aim of establishing a presence in these fields. For our marketing structure, in 1998, we introduced a “team structure,” with teams based in secondary medical care areas (where multiple MRs are responsible for a designated area), and are using area management in which teams cultivate their own areas. Going forward, we will create a framework for teams to assist one another and achieve their targets by refining our activities to address increasingly diverse medical needs swiftly and systematically.